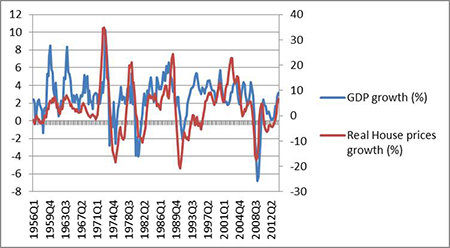

GDP growth (Left Hand Side axis) and Real House prices growth (Right Hand Side axis)

Costas Milas is Professor of Finance in the University of Liverpool’s Management School

The Bank of England (BoE) has just taken action to cool the housing market. In particular, the BoE’s Financial Policy Committee (FPC) said that it would only allow 15 percent of new mortgages to be at multiples higher than 4.5 times a borrower’s income.

So, why did the BoE take action and would it work?

To answer these questions, I will rely on historical (since the 1950’s) house prices data provided by Nationwide.

In 2014 Q1, annual house prices inflation stood at 9.2% (compared with the 8.1% average of the last 60 years or so). So, house prices growth is higher than its historical average. Although London house prices are “taking off” at an annual average growth of 18% (twice as much as the historical average), house prices in the rest of the country are also picking up.

For example, house prices in the North, North West and Yorkshire & Humberside are also growing strongly (but still remain 1-2 percentage points below their historical average growth rate).

But why should we be worried about rising house prices? The Figure above plots annual real house prices growth (house prices growth less Retail Price Index inflation) together with UK real GDP growth over the 1956-2014 period.

One can notice the following:

- There is a strong positive correlation (equal to 0.56) between the two series.

- Both in 1990 and in 2008, a big drop in real house prices preceded recessions. In fact, statistical tests (called Granger causality tests) indicate that real house prices deflation causes GDP recessions.

- Real house prices inflation turned negative in 1989q4 (and stayed negative) well before the GDP recession in 1991q1. On the other hand, real house prices inflation turned negative in 2008q1 just two quarters before (the subsequent) GDP recession. This suggests that the BoE is indeed justified in preventing the formation of a big house price bubble which will eventually burst and cause (another) deep recession.

Therefore, would macro-prudential policy (in the form of restricting mortgages) actually work? From a statistical point of view, growth of house prices precedes growth of mortgage debt. Hence, restricting the growth of mortgage debt (in an attempt to put a lid on rising house prices) would probably not be as effective as the FPC would like. Instead, we should be looking at raising interest rates.

With this in mind, would it not also make more sense to merge the BoE’s Monetary Policy Committee (that is, the Committee which sets interest rates) with the Financial Policy Committee (the Committee which, amongst other things, looks at house price movements) since their duties largely overlap?