Kieran Maguire is a football finance expert in the University of Liverpool Management School‘s Centre for Sports Business

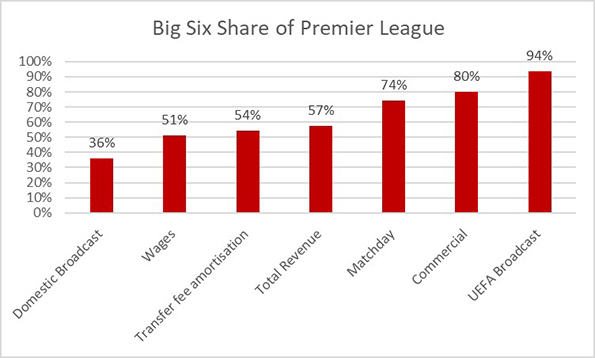

The value of Premier League clubs decreased by 1.6% overall to £14.7 billion, with the ‘Big Six’ (Manchester United and City, Liverpool, Arsenal, Chelsea and Spurs) making up £10.9 billion (74%) of this total (2017: £9.9 billion 67%).

Manchester City overtook local rivals Manchester United at the most valuable club in the division as higher wages and lower profits had a negative impact at Old Trafford.

The gap between the bottom club in the ‘Big Six’ and the next highest valuation is now nearly £1 billion.

The only major deal in the Premier League during 2017/18 was in relation to Stan Kroenke acquiring the remaining 30% of the shares in Arsenal that he didn’t already possess for £550 million, which valued the club as £1.83 billion. In our 2017 club valuation report we estimated Arsenal to be worth £1.82 billion.

Within the table there have been some significant changes compared to the previous season, with Liverpool, Chelsea and Spurs showing major increases, and Arsenal and Leicester showing large falls due to non-participation in the Champions League.

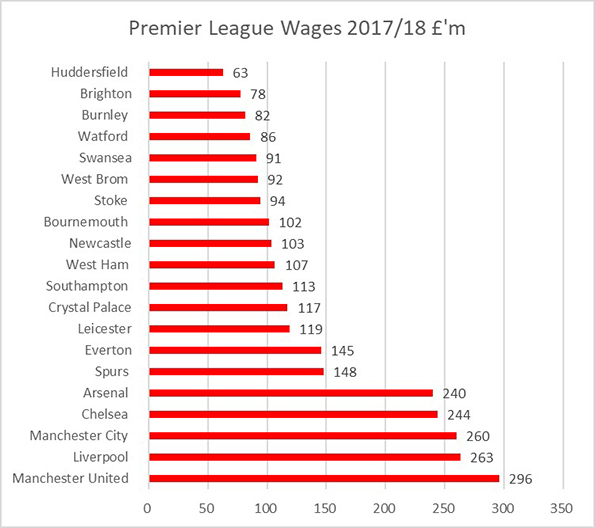

There were also smaller falls in the value of some mid-tier clubs due to weaker cost control in a season where revenue in the Premier League increased by £253 million wages rose by £356 million.

Valuation Table

Methodology

The valuation method is broadly based on the Markham Multivariate Model created by Dr Tom Markham, who presently is a senior executive for Sports Interactive, creators of Football Manager.

The model takes into consideration revenue, profits, non-recurring costs, average profits on player sales over a three-year period (which ties into how the Premier League calculates profits for Financial Fair Play purposes), net assets, wage control and proportion of seats sold.

The figures are derived from the financial statements sent to Companies House.

The model has been revised since 2017 to take into consideration some of the more complex ownership issues arising in the Premier League.

The model assumes that the club retains its position in the Premier League. For those clubs that have subsequently been relegated to the Championship realistic values are 60-70% lower.

The formula used is

((R+A) x ((R+P-NR+D)/R) x C)/W where

R = Revenue

A = Net Assets

P = Profit

NR = Non-recurring items

D = Average player profit over last three years

C = Average attendance/ Stadium Capacity

W = Wages/Revenue

Club by Club Analysis

1: Manchester City £2,364 million (2017 2nd £1,979 million)

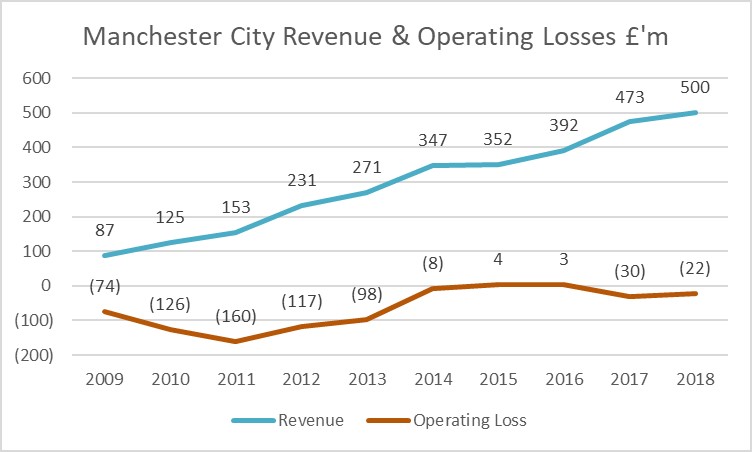

Manchester City’s value increased in 2018 due to a combination of higher revenue and lower wages, the latter perhaps surprising given the club won the Premier League and would have paid out substantial bonuses. City did however sell many players at the start of 2017/18 which generated £39 million in profits offsetting operating losses as well as removing some high earners from the wage bill.

The ownership model of Sheikh Mansour which effectively means that the club is debt free means that there are no loan interest costs and no dividends are paid to shareholders either.

Critics of Manchester City will point out that it is part of a multi-club ownership model and that there are commercial deals with related parties which might not apply should the club be sold and therefore a prospective owner might not be willing to pay this value.

2: Manchester United £2,087 million (2017 1st £2,463 million)

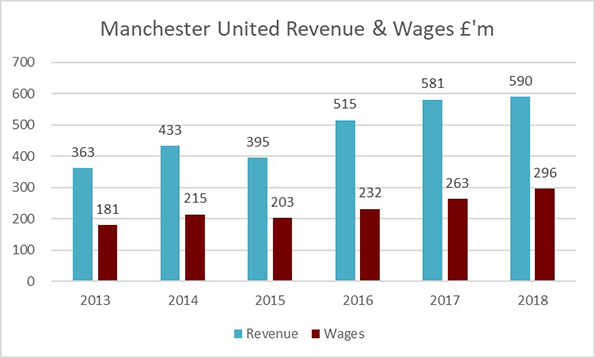

Manchester United’s value decreased by over £350 million in 2017/18 due to revenue increasing by only 1% but wages increasing by 13%. This was responsible for a big fall in profits.

Compared to their city rivals Manchester United also had to deal with finance costs of £18 million and dividends paid to shareholders of £22 million which reduced net assets.

Whilst Manchester United qualified for the Champions League last season it was on the back of winning the Europe League the previous season and this meant that it earned less than those clubs who had finished in the top four of the Premier League. A second place finish in 2017/18 should boost the club’s UEFA revenue this season.

Manchester United still had the highest revenue of any club in the Premier League but the increased costs meant they relinquished the top spot in the valuation table.

3: Spurs £1,837 million (2017 4th £1,445 million)

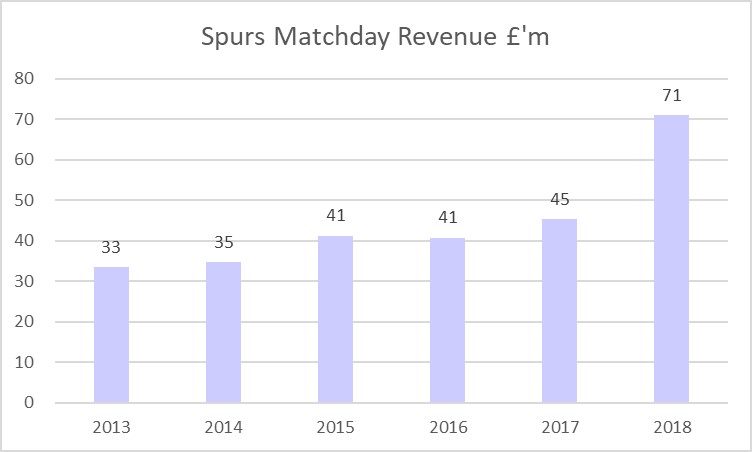

Spurs narrowed the gap on Manchester United by £800 million in 2017/18 due to higher revenues as a result of playing at Wembley with higher attendances and hospitality packages, Champions League participation and new commercial deals.

The move to the new stadium potentially can take Spurs from annual matchday revenues of £40-45 million at White Hart Lane to over £100 million. They will have to pay interest on the loans taken to fund the stadium construction but should still have a net financial benefit from the move.

Higher revenues and tight cost control were the main drivers of Spurs world record operating profits of £157 million although these were also helped by the sale of Walker, Wimmer and Bentaleb proved to be lucrative too.

In addition, Spurs wage bill is less than half that of Manchester United and the club has by far the lowest wage/revenue percentage in the division. With wages being just £39 for every £100 of income Spurs have the best wage cost control in the Premier League.

4=: Chelsea £1,615 million (2017 6th £1,093 million)

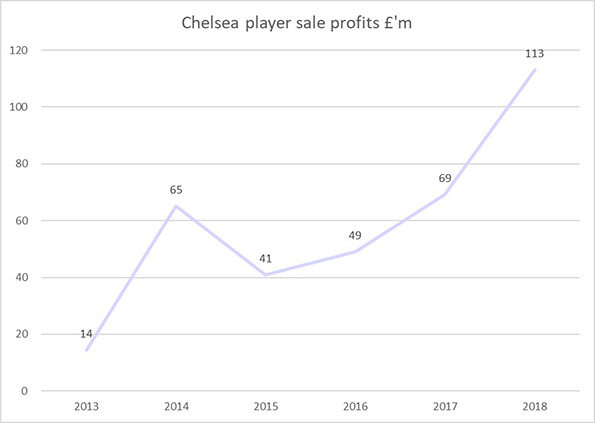

Chelsea’s value increased in 2017/18 despite finishing 5th compared to winning the Premier League the previous season. Participation in the Champions League was worth £58 million, and this helped reduce wages/revenue from 61% to 55%. A new kit deal with Nike commenced in 2017/18 and this generated additional revenue on top of more matches in European competition.

The sale of Costa, Matic, Ake and Cuadrado helped generate player sale profits of £113 million for Chelsea which further increased the club value. Chelsea’s business model appears to be one of selling at least one player each season for a substantial gain.

Expect Chelsea’s value to fall in 2018/19 due to only being in the less lucrative Europa League. The club’s ability to compete with its peer group financially will also be influenced by constraints at Stamford Bridge, where attendances are lower than the other Big Six teams due to the capacity being 41,000 seats.

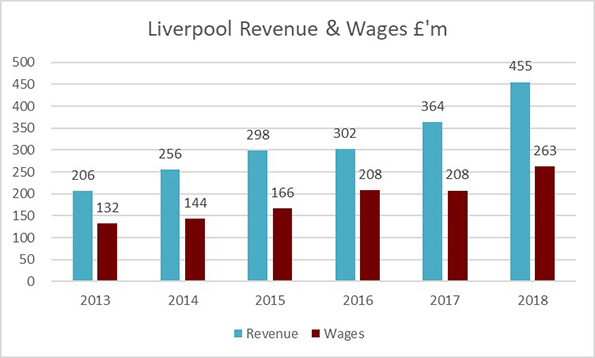

4=: Liverpool £1,595 million (2017 5th £1,130 million).

Liverpool’s value has increased substantially due to the club reaching the Champions League final, which was worth £72 million in prize money alone, and increased capacity at Anfield which increased matchday income. The sale of Coutinho helped Liverpool to a £131 million profit.

Wage costs increased by over a quarter as the club invested £195 million in Salah, Van Dijk, Oxlade-Chamberlain and Robertson with wages in line with the large transfer fees. Whilst wages have doubled since 2013 Liverpool have more than doubled revenues too so have good wage control metrics.

Expect Liverpool to overtake Chelsea in the current season due to finishing first or second in the Premier League this season. This will increase revenue further as well as extra prize money available in this season’s Champions League compared to 2017/18.

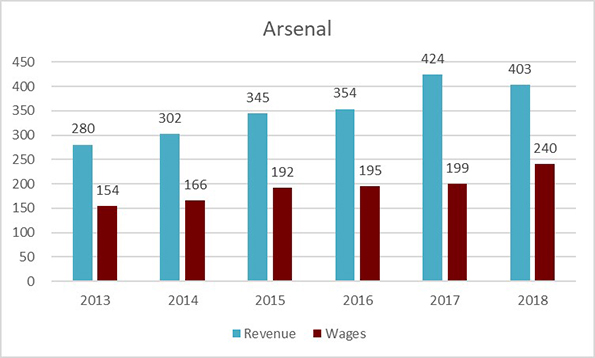

6: Arsenal £1,368 million (2017 3rd £1,822 million)

Arsenal’s value fell by nearly a quarter in 2017/18 due to only qualifying for the Europa League instead of the Champions League. Consequently, revenue decreased by £20 million but wages increased by £40 million, resulting in the wage/revenue ratio increasing from 47% to 60%.

Arsenal also incurred £17.2 million of costs as a result of staff changes following Arsene Wenger’s departure.

Arsenal had to rely on player sales to reverse operating losses of £18 million as Oxlade-Chamberlain, Sanchez, Giroud and Walcott helped generate a profit of £120 million on disposals.

The club is unlikely to show a significant reversal of its value in 2018/19 due to once again only being in the less lucrative Europa League.

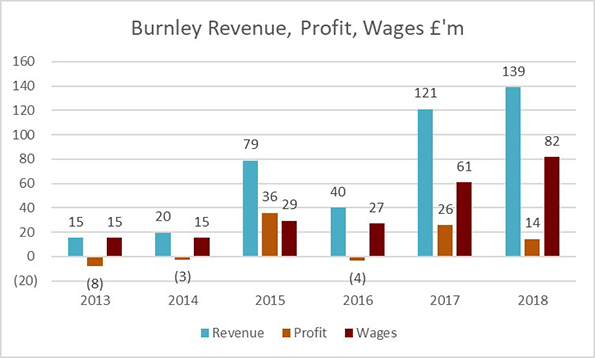

7: Burnley £398 million (2017 12th £352 million)

A small increase in value but a big jump in the table for Burnley, who are arguably the most sensibly run club in the Premier League financially.

Revenue increased by £18 million due to greater prize money for finishing 7th in the Premier League but wages were the third lowest in the division.

The sale of Michael Keane to Everton helped profits increase to £45 million and with the club having zero borrowings the balance sheet looks strong.

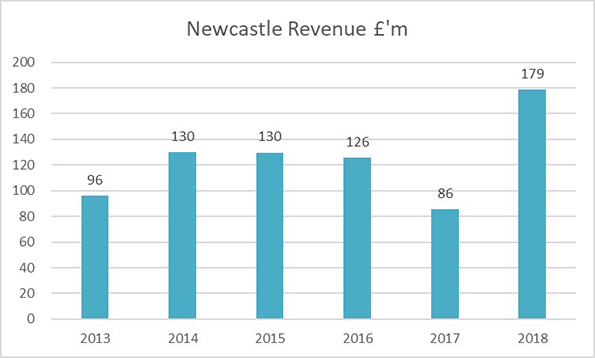

8: Newcastle £383 million (2017: Championship)

Newcastle in 2017/18 were the first team promoted from the Championship to report a decrease in wages from the previous season, although a look at the fine print of the accounts does suggest these figures are slightly misleading.

A 10th place finish in the Premier League helped generate revenue of £179 million, nearly a third up on their most recent year in the top flight and more than double of the previous season.

Profits were £21 million due to good cost control and modest transfer spending and owner Mike Ashley did not charge any interest on the £144 million he had lent to the club.

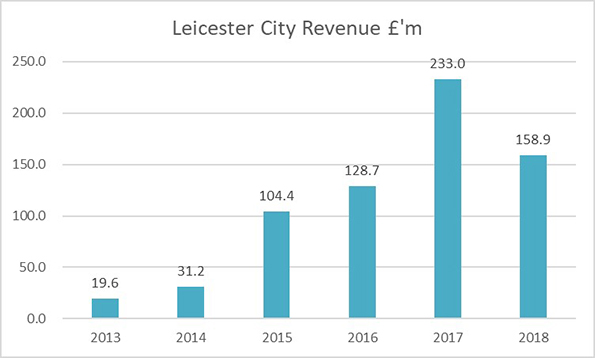

9: Leicester £378 million (2017 7th £955 million)

Whilst the decrease in Leicester’s value is spectacular, the valuation is more a reflection of the impact that Leicester’s progress in the Champions League made the previous season, and the value was only realistic had the club continued to qualify for this competition.

Revenue fell by £74 million due to fewer home matches and no UEFA prize money, but wages increased slightly.

For a club what was generating less than £20 million in revenue six years ago Leicester’s progress is impressive in being in the top half of Premier League club valuations.

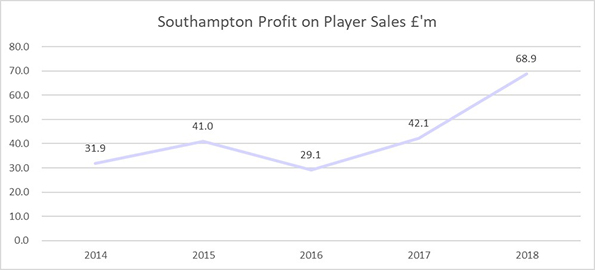

10: Southampton £369 million (2017: 8th £472 million)

Southampton’s value fell due to a 17th place finish in the Premier League compared to 8th the previous season, no Europa League qualification and less progress in the domestic cup competitions.

This resulted in income falling £30 million but there was no change in wages. The club made losses on a day to day basis and needed the Van Dijk sale to convert this into a profit.

Southampton have been very successful selling players recently, with profits on disposals of £213 million in the last five years.

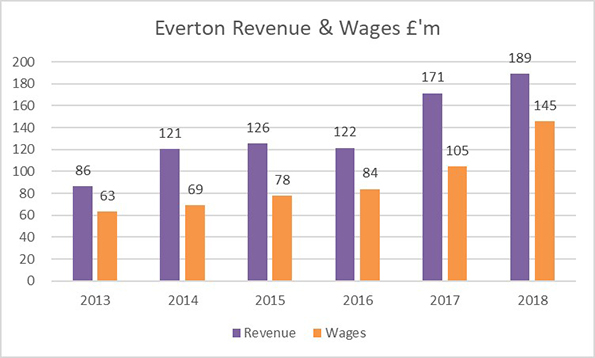

11: Everton £363 million (2017 9th £425 million)

Everton’s value fell due to wages rising four times faster than revenue as the club invested heavily in new players such as Sigurdsson, Keane, Pickford, Rooney and Walcott. As a result, the Everton wage bill was only £3 million lower than that of Spurs.

The increased costs also result in the club making an operating loss of £64 million and it required substantial player sales to reduce these losses.

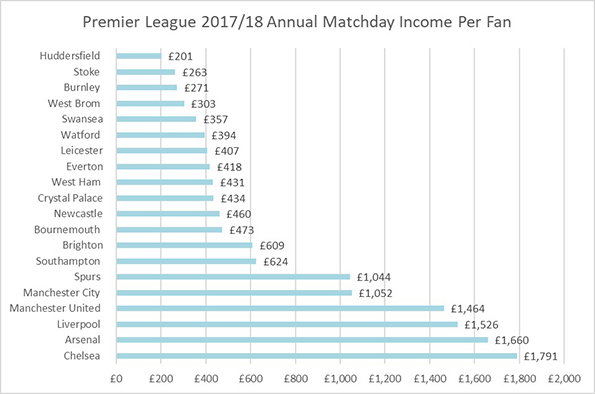

Everton are limited by the size and age of Goodison Park, where matchday revenues of £18 million make up just 9% of the total and a move to a new stadium is essential if the club wishes to start to challenge the ‘Big Six’ financially.

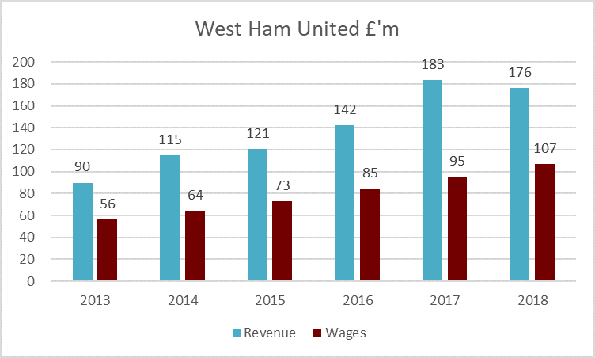

12: West Ham £291 million (2017 11th £368 million)

West Ham’s value decreased in their second season at the London Stadium as revenue decreased by 4% due to a slightly lower finish in the table and wages increased by 12%.

With capacity at the stadium increasing this season to 60,000 then expect income and value to rise in 2018/19. There will still be a large gap with some of its London rivals as relatively low season ticket prices mean that the club does not monetize the fanbase to the same extent as some local rivals who have a more affluent demographic.

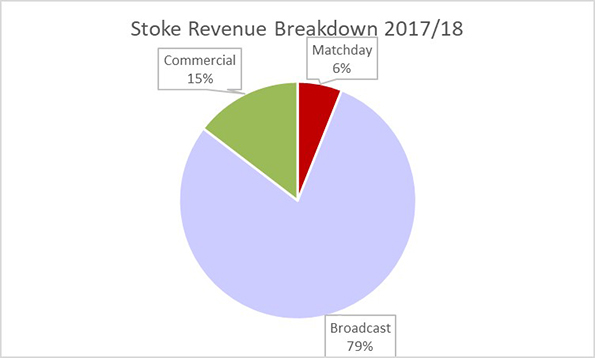

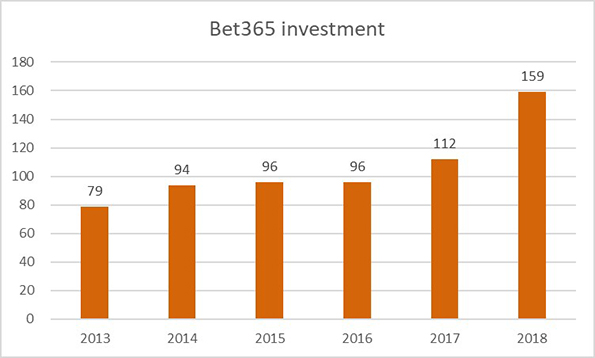

13: Stoke City £238 million (2017 14th £300 million)

Stoke City’s value fell due to lower revenue, partly as a result of finishing six places lower in the Premier League than the previous season and wages increasing by 11%.

Stoke went from making a modest profit in 2016/17 to a £30 million loss last season.

The club is dependent upon owners Bet365 and the Coates family for funding, but this appears to be likely to continue despite relegation to the Championship. The company’s combination of shares and loans in Stoke increased by £47 million to £159 million in 2017/18.

14: Huddersfield £231 million (2017 Championship)

Huddersfield’s relatively high value was due to a cautious investment in players and wages in their first season in the Premier League and the second highest operating profits (profits before player sales) in the division.

The club also benefitted from ‘first season syndrome’ with some players being on contracts initially negotiated in the Championship which, whilst containing promotion clauses, are likely to be lower than more established Premier League clubs.

15: Brighton £224 million (2017 Championship)

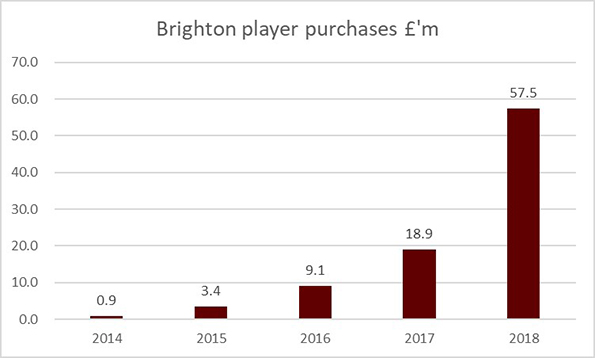

Brighton, like Huddersfield, made survival their objective last season in their first Premier League season. They spent more on signings in 2017/18 than in the club’s previous 117 seasons added together.

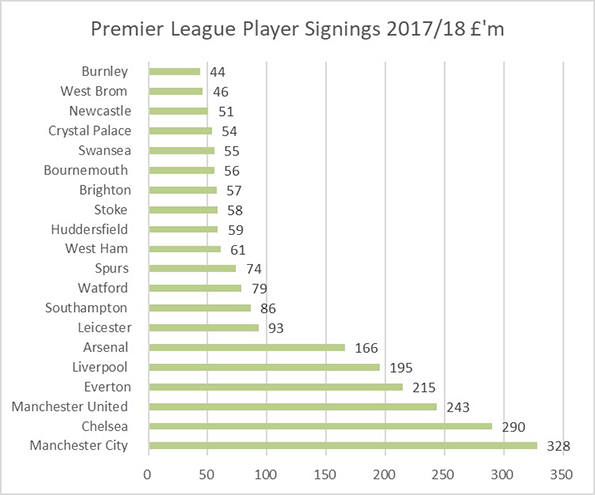

Whilst £57 million was a significant player investment for Brighton it was still modest by Premier League standards.

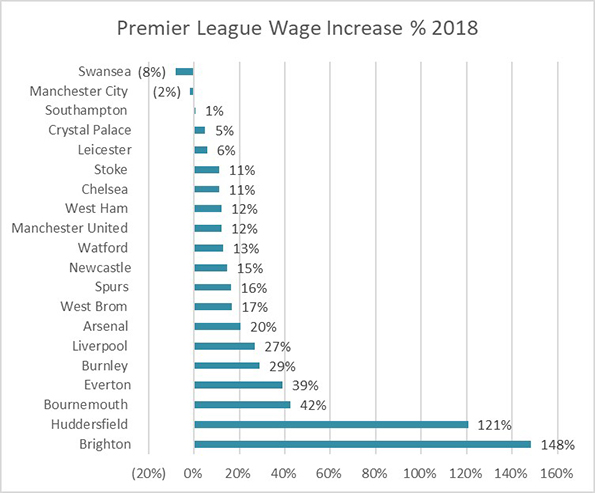

Wages of £56 for every £100 of revenue is part of the reason for the club value but it is unlikely to keep this metric so low due to further recruitment in 2018/19 and enhanced contracts for some existing squad members.

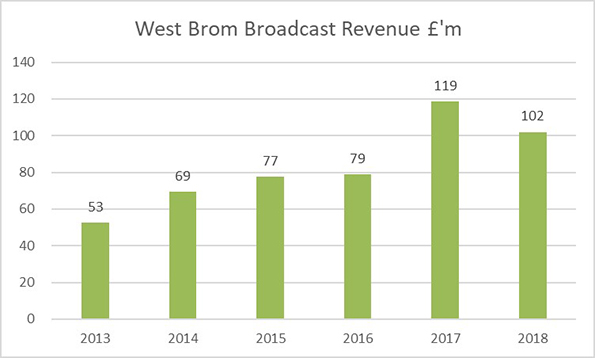

16: West Bromwich Albion £223 million (2017 10th £381 million)

A significant fall for West Brom who like many other clubs suffered the twin challenges of lower revenue and higher wages, resulting in profits turning into losses. Finishing bottom of the Premier League compared to 10th the previous season was the main reason why broadcast revenue fell, and this was the main driver for the 10% decrease in total income.

Consequently, the wages/revenue ratio increased from 57% to 74%, above UEFA’s danger level mark of 70%.

17: Watford £214 million (2017 15th £283 million)

Whilst Watford had a small increase in revenue in 2017/18 this was more than offset by significant wage growth. Fifteen Premier League clubs had double digit percentage wage increases in the season.

This resulted in Watford losing £25 million from day to day operations and this was only slightly offset by player sale profits of £3 million.

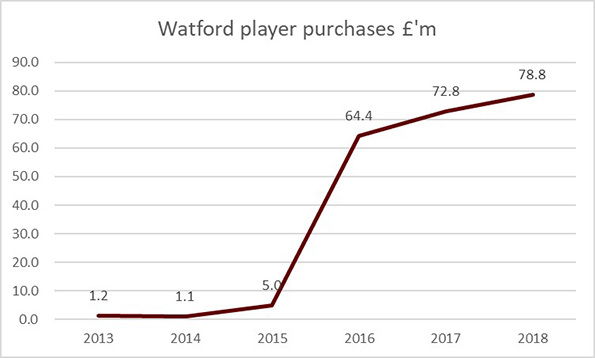

Watford spent significant sums on players in 2017/18 which were funded by owner loans which have increased by £80 million since the club was promoted in 2014/15.

18: Crystal Palace £200 million (2017 19th £204 million)

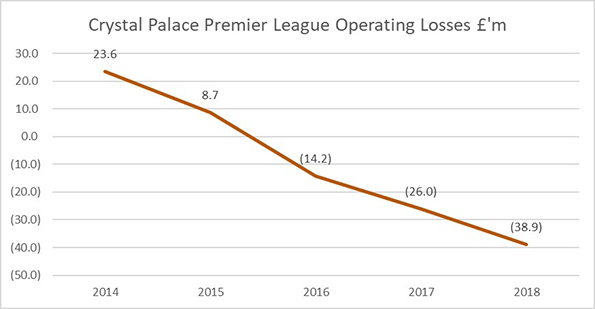

Crystal Palace’s low position in the value table seems initially harsh as the club have established themselves as a Premier League regular since promotion in 2012/13.

The main reason for the value is that the club’s strategy of paying high wages compared to revenue and investing £240 million in player signings in its first five years in the Premier League.

£109 in wages and amortisation costs for every £100 of income means the club is reliant upon player sales to break even and whilst this was achieved in 2016/17 via Bolasie moving to Everton there were no such sales last season.

This resulted in a significant loss which kept the club value low and the club’s profits have fallen every year since promotion which has a further negative impact upon the valuation.

19: Bournemouth £180 million (2017 13th £345 million)

Bournemouth’s value halved due to revenue slightly falling but wage costs increasing by over 40% following significant player investment. This resulted in the club moving from an operating profit to a loss for 2017/18.

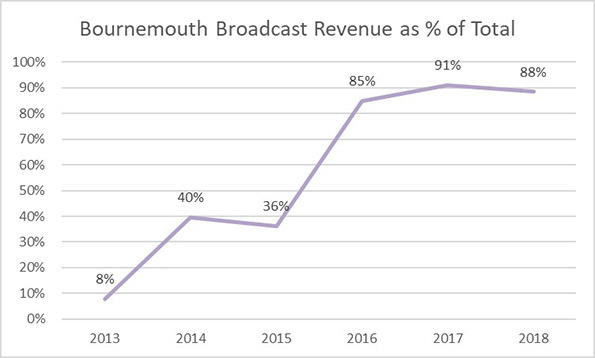

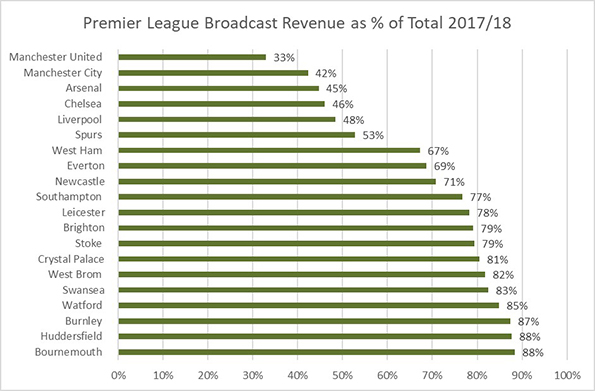

With a stadium capacity of only 11,000 the club is heavily reliant upon broadcasting income for most of its total, and the club, which was in the third tier of English football as recently as 2012/13, has been transformed by membership of the Premier League.

Bournemouth are not alone in their dependency on broadcast income with eleven Premier League clubs generating at least three-quarters of revenue from this source.

20: Swansea £167 million (2017: 20th £182 million)

Swansea finished bottom of the table for the second season running. Revenue was static and wages fell by 8% possibly due to bonuses for avoiding relegation not being triggered.

Swansea was another club for whom wages and amortisation costs exceeded revenue. The club also wrote down player values by £15 million at the end of the season following relegation.

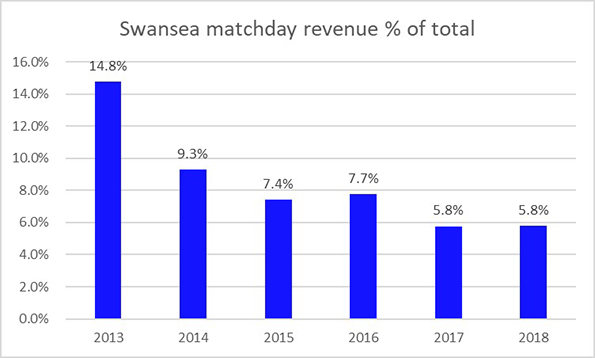

A relatively small capacity stadium means that matchday income is a very small proportion of total revenue especially following the two new broadcast deals that commenced in 2013/4 and 2016/17.

Relegated Clubs 2016/17

The values for the three clubs relegated from the Premier League in 2016/17 were Hull £224 million (16th) Middlesbrough £219 million(17th) Sunderland £216 million (18th).

Conclusions

The Big Six clubs continue to be very valuable and their dominance of revenue streams is likely to ensure that the gap between themselves and the remaining clubs in the Premier League is maintained.

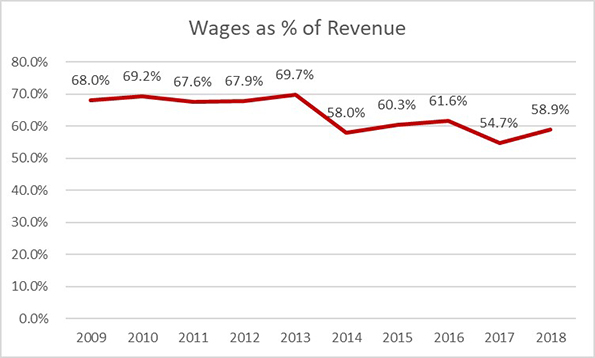

Cost control is proving to be very difficult for all clubs in the division, especially in terms of wages and this may restrict future growth in the value of clubs especially with broadcast revenue growth slowing. Wages as a proportion of revenue fell to the lowest figure in a decade in 2016/17 when the new broadcast deal commenced but increased in 2017/18 and could easily exceed 60% in the next season.

The Premier League will continue to be an attractive proposition for investors, both those looking for a financial return as well as those with other motives due to its universal appeal to broadcast audiences.